Idea & Vodafone merger agreement has created India’s first SMP (Significant Market Power) in the telecom sector. Trai defines SMP as an entity that has 30 pc of the market share. The combined entity crosses this threshold. For the consumer marketshare, it has 35 pc and for revenue marketshare, 41 pc. Thus, it is the country’s largest telco. With 400 million customers, it would hold 1,850 MHz of which 1,645 MHz is liberalised spectrum, acquired through auctions. It has the largest broadband spectrum portfolio with 34 carriers of 3G and 129 carriers of 4G across the country.

The amalgamation has exclusions also. These are VIL’s (Vodafone India Limited) 42 pc stake in Indus Towers Ltd, its international network assets and information technology platforms. Excluded also are the following tower assets of both Idea & Vodafone: in-building solutions (IBS), cell-sites on wheels (COW) and MSC (mobile switching centre) towers and tenancies.

However, ICL (Idea Cellular Ltd) will contribute its 11.5 pc stake in Indus Tower to the merged entity. Also its standalone towers with 15,400 tenancies will be merged. Vodafone will also merge its standalone towers with 15,800 tenancies.

The total debt of the merged entity is expected to be about Rs 107,900 crore and the tower assets will be used to reduce leverage. So before transaction completion, Vodafone and Idea intend to sell their standalone tower assets and Idea’s 11.15 pc stake in Indus Towers. Vodafone will also explore strategic options for its 42 pc stake in Indus Towers. Both options of a partial or a full disposal will be considered, according to VIL.

As part of the merger transaction, certain costs are anticipated on the regulatory front.

These mainly pertain to spectrum liberalization costs and are expected to have a NPV impact of Rs 3,000 crore. This would include paying up for spectrum which were made available as entry spectrum (4.4 MHz & 2.5 MHz) and these would be payable at auction discovered prices. This is mandated by the DoT’s M&A guidelines. This would also include requirements to meet regulatory spectrum caps and market share thresholds in certain circles one year after completion of the transaction and for conversion of unliberalised spectrum to liberalised spectrum. For more details on the financial, management and brand structure of the SMP read our cover story.

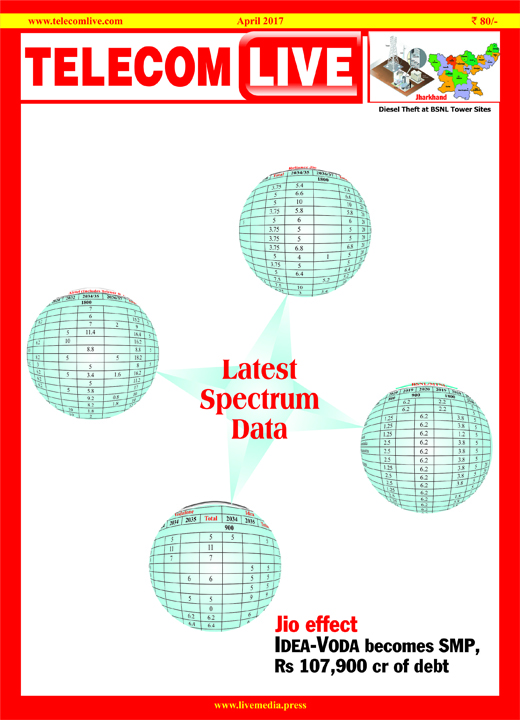

For sometime now, the spectrum map in the telecom sector has been changing. Therefore, our cover story includes extensive spectrum data. A comprehensive account and operator-wise details of spectrum assets with tenure are given.

Plus there are many investigative, regulatory and policy stories in this issue.