Will the government bite the bullet? This is the basic liberalization question which is asked of every government and it pertains to two domains namely, subsidies and privatization. Both issues stir up a political whirlpool and therein begins stalling and obstructions. Given this past experience, the government has shown deft and mature management by unveiling a multi-sector ambitious Rs 600,000 crore National Monetisation Pipeline (NMP). At the heart of NMP is private participation, operational efficiency, better services and unlocking of economic value. Most countries are imposing tax burdens to raise revenue to meet the pandemic-related exigencies, but India under the Modi government is placing no such demand on ordinary citizens, instead it has turned the public health emergency into a liberalization opportunity.

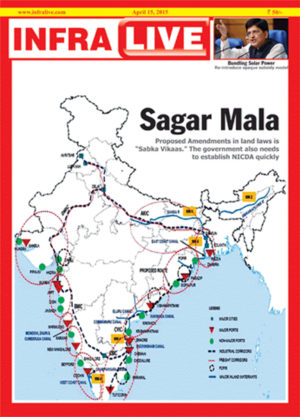

13 sectors have been identified: Roads and railways top the list, followed by power transmission & generation, telecom, warehousing, mining, natural gas pipeline, product pipeline, aviation, urban real estate, ports, and sports stadiums. The identified assets will be given for specified periods to private parties for expansion, O&M, etc and the assets will be taken back once the concession period is over.

While most sectors have had large-scale experiences with monetization, not so the Railways and it is the government’s biggest challenge. The earmarked projects of the Indian Railways for asset monetization is comprehensive involving stations, trains & its operation, tracks & its infrastructure, goods sheds, konkan / hill railways, railway real estate, and dedicated freight corridor. All this is being done for the first time.

And there are many regulatory issues involved. Thus, there is an urgent need for a Rail Regulatory Authority and setting up of a universal service obligation (USO) mechanism to support unviable operations of the Indian Railways. Since high revenue operational routes are being given out for monetisation, the regulator has to ensure that the Indian Railways is adequately compensated to subside its operations in the areas where its income is far lower than expenses. Then there is the important issue of determining track access charge (TAC) as even the Indian Railways will have to pay it to private concessionaire. TAC cannot be kept too high as it will directly reflect on fare and freight charges.

The cover story details the projects and their monetisation values.