CBI FIRs on financial frauds involving the promoters of GVK and Videocon raises three germane questions. First, what kind of nexuses result in public sector companies overvaluing private assets for acquisition. Second, why government entities routinely allow themselves to be cheated of revenues by their private partners? Third, why do regulators and public entities ignore overwhelming evidence of fraudulent practices by private parties?

The GVK FIR, the reasons thereof as also the sections of the law applied come as no surprise. GVK led consortium owns Mumbai International Airport Ltd (MIAL) in a joint venture with government, which holds a 26 per cent stake through AAI. Fake contracts, siphoning off money from the JV, land grabs, allotment of airport retail outlets to friends and employee nexuses of GVK, violation of OMDA, not making any equity investments themselves but making ordinary fliers and citizens pay through expensive UDF is their modus operandi. CAG May 2014 Report had expansively documented every parameter. The present FIR into the recent siphoning and misuse of funds causing a loss of Rs 705 crore to MIAL is the latest episode in its long running manual of fraudulent practices. Both father-son duo – GVK Reddy, the chairman of the GVK Group and his son GV Sanjay Reddy, managing director of MIAL – have been booked under IPC sections related to forgery and cheating.

The CBI FIR against Videocon group chairman Venugopal Dhoot is on corruption related to financing of their oil and gas assets in Mozambique in nexus with unidentified officials of a bank consortium led by SBI.

CBI’s FIR reveals its PE findings sequentially. In 2008, Videocon Hydrocarbons Holding Ltd (VHHL), a subsidiary of the Videocon Industries Ltd (VIL), acquired 10 per cent “participating interest” in Oil and Gas Block in Rovuma Area 1 block, Mozambique, from the US-based Anadarko. Thereafter, it obtained a Standby Letter of Credit (SBLC) facility of $2,773.60 million for appraisal and development of overseas oil and gas assets in Mozambique, Brazil and Indonesia and other funding requirements in relation to refinancing. Abuses began. Outstandings of Standard Chartered Bank, London began to be cleared through refinancing, simultaneously Videocon continued to take loans from SCB without disclosing to the bank consortium and kept on availing increased refinancing amounts. The bank did not carry out any verification and nearly half of the loan amount was diverted.

The Mozambique asset was later acquired by ONGC Videsh Ltd and Oil India Ltd in January 2014 for $2,519 million, a whopping overvaluation and was revealed by us more than three years ago in our April 2017 edition. The CBI needs to investigate such super-high valuation.

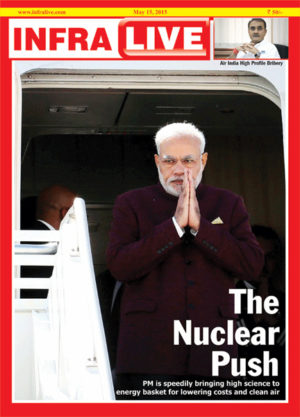

All these developments have a long trajectory. Read all details in the cover story. Plus, a comprehensive coverage related to commercial coal mining and recent auctions has been put together for our readers.