E-commerce is now the main pillar of retail business and has dislodged traditional retail networks in ways, unimaginable five years ago. Industry forecasts are that this business will grow from the present base of $25 billion to $100 billion in the next five years. But the marketplace presence, consumer-facing e-commerce was not a part of policy. E-commerce was only meant for B2B trades. But so used everyone had become to the online retail purchases that no one noticed that this was disallowed or even if they knew they let it pass. The why question, is ofcourse a matter of investigation as are the complicated company structures of most e-commerce firms which were designed to receive money from globally investors while the e-commerce platforms themselves maintained a separate entity.

To set the record straight, for the first time the policy announcement for marketplace trades was made on March 29, 2016 that too under certain conditions when the government issued guidelines allowing B2C trade on e-commerce platform to entities having foreign investment. A careful reading of the policy shows that the FDI policy is a furtherance of the Make in India programme of the government, which companies like Amazon and Alibaba may consider to be regulatory hurdles. Since they already possess exhaustive sourcing assemblies, they may be averse to striking new localization strategies.

The new FDI policy does not permit Inventory based trade on e-commerce. It allows marketplace trades for three categories, out of which two categories are for local manufacturers, and one category is for single brand brick & mortar stores.

And there are further restrictions. Massive discounts cannot be offered, one vendor or their group company’s share cannot exceed 25 per cent of the volume of trade on the marketplace; and post-sales delivery & customer satisfaction will be the responsibility of the seller. Read our cover story for details, it is also a ready reckoner on policy positions, on what is allowed and what is not.

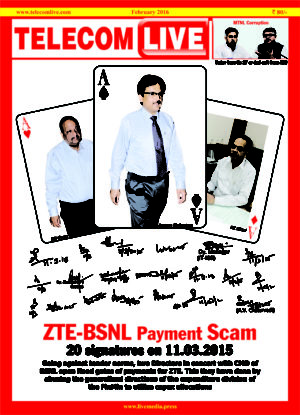

Another important Trade and Policy development story comes from the US. It is about the blacklisting of four entities of Chinese major ZTE found to be guilty of subverting US foreign policy and national security priorities on trade with Iran. The US used the trade lever with Iran to make it behave responsibly on the nuclear question. For successive US governments, this was a red line; any entity crossing it is punished, including businesses. That is how the US got Iran to the negotiating table. No such policy exists in India, though we deal with equally insurmountable national security challenges. And thus we see, China taking a stand inimical to India on terrorists who plot and attack India repeatedly and yet Chinese companies like ZTE have their books filled with government orders and coffers with Indian money.